Bitcoin isn’t So Scary: a Guide to Accepting Bitcoin in Your Online Store

It’s time to face the facts: Bitcoin is everywhere, and growing in popularity. I even wrote an article where I debated the pros and cons of accepting Bitcoin from a business perspective. It’s now time to look at the actual steps needed to accept Bitcoin at your online store.

Common Issues

Let’s start by looking at some common issues or questions retailers have around accepting Bitcoin. The companies that allow you to accept Bitcoin tend to solve all of these issues in the background, but we need to understand what they are and how they affect you.

Pricing Your Products in Bitcoin

It’s hard to understand how we can price our products using Bitcoin when 1 single Bitcoin (1 BTC) is worth around $500 (the value is changing all the time). However, there are smaller denominations in which Bitcoins can be spent or received. This is similar to how we can use 5c, 25c, etc coins and then $1, $5, etc bills and we can use them in different combinations to pay any amount.

Bitcoins can be spent in fractions or smaller denominations. These are some of the possible fractions of Bitcoin:

- 1 BTC = 1 bitcoin

- 0.01 BTC = 1 cBTC = 1 centibitcoin (also referred to as bitcent)

- 0.001 BTC = 1 mBTC = 1 millibitcoin (also referred to as mbit or millibit or even bitmill)

- 0.000 001 BTC = 1 μBTC = 1 microbitcoin (also referred to as ubit or microbit)

As you can see, you don’t have to worry about how users can spend their Bitcoin. Another issue that quickly comes up is that Bitcoin changes its value quite often, which means that 1 BTC is worth $500 today but may be worth $550 in two days. This fluctuation can be hard to take into account, since we obviously don’t want to sell our products for less than what they are worth.

Luckily for us, the companies that help retailers accept Bitcoin make it easy to avoid any fancy calculations. You simply enter the value of your product in your local currency (e.g. USD, CAD, EURO, etc) and then their software translates that into a Bitcoin price in real time. The Bitcoin price of your product will change depending on whatever the current market is at that moment.

Converting Bitcoins into Local Currency

Now that we know that we can price our products in Bitcoin without much hassle, we need to worry about converting Bitcoin into our local currency. The high fluctuations of Bitcoin can make this troublesome for retailers. Imagine processing $1000 worth of money on Bitcoin on Monday and then the value of Bitcoin drops making your $1000 into $900 within a few days.

This would be a terrible way of doing business. To prevent this, we will look for companies that will automatically convert our Bitcoins into our local currency. This conversion will usually happen once a day and “lock” the price of Bitcoin for you.

For example, let’s say you sold $100 worth of goods through Bitcoin but the price changed slightly towards the end of the day. Your provider will actually lock the price of Bitcoin at the moment your customers bought it and will convert it to local currency for you at that price. This means that you will always get the exact amount of money you expect no matter what the current value of Bitcoin is.

As a sidenote, these conversions are done when your provider “purchases” your Bitcoins and gives you USD, CAD, etc in return. The locking of the price is great because you don’t have to worry about losing money. If you’re wondering why any provider would be willing to lose money like this, then don’t worry too much. The locking of the price can also be beneficial to the provider, especially if the value of Bitcoin increases within the day.

Handling Refunds

In our previous article, we mentioned a potential issue when handling refunds. If someone buys an item at 1 Bitcoin and then returns it later, do you give them 1 Bitcoin back? The price of Bitcoin could have gone up, which means you are basically paying a customer to return an item!

You can take two approaches here, one which is simpler than the other one. First, you can establish a rule of no refunds when paying through Bitcoin. While the rule sounds harsh, it will make a lot of things simpler. One aspect of Bitcoin is that users can make purchases anonymously-a feature many people love. They could purchase an item without having to provide the usual billing address information. While good for the buyer, this lack of information would make it even harder to issue a refund to the right person.

Your second option is to refund the value of the product in your local currency and then convert it to the Bitcoin price at the time of the refund. You would also require customers to provide an email or other identifying information before you can issue the refund.

Integration Bitcoin: Looking at All the Options

Now that we know about all the potential issues and how to solve them, let’s look at how you can integrate Bitcoin into your existing online store. We will focus on two providers: Coinbase and Bitpay.

Fees

Let’s look at how both companies compare when it comes to fees. While Bitcoin is touted as a possible way to send money for free, providers need to make a living and they usually do it by adding a transaction fee somewhere. This transaction fee is usually lower than what credit card companies charge, though.

Coinbase doesn’t charge any transaction fees BUT they charge you when you convert your Bitcoins into your local currency. This fee is 1% plus $0.15 per bank deposit. If you process $100 worth of money through Bitcoin, you would pay $1.15 (1% plus $0.15) to have those Bitcoins converted into USD and transferred to your bank. You would see $98.85 in your bank account after all the fees are paid. Coinbase is also currently waiving any fees until you process more than $1 million dollars making it effectively free for most retailers.

Bitpay is actually completely free. They recently announced a new plan which makes it completely free to process Bitcoins, convert them to your local currency and deposit them into your bank account. Bitpay makes their money on other plans where they offer phone support and extra integrations for software like Quickbooks.

In terms of currencies, Coinbase currently only supports transfer to USD, while Bitpay supports 9 currencies. If you’re not in the US, then Bitpay will probably be the best option based purely on the currency support.

Getting Paid

I wanted to cover this section briefly to make it really clear how you will get paid. Both companies make it easy to add a bank account to which they will deposit your local currency. The instant conversion can be turned on and then the whole process will happen automatically without any intervention. It’s really quite simple to set up and get going. You can read about the process for Coinbase here and for Bitpay here.

Adding “Pay with Bitcoin” Buttons

There are several ways in which you can let your users pay you with Bitcoin, such as buttons, hosted-pages and integrations with popular tools like Shopify. I will say that Coinbase has a nice advantage here because their documentation is a lot more clearer than Bitpay.

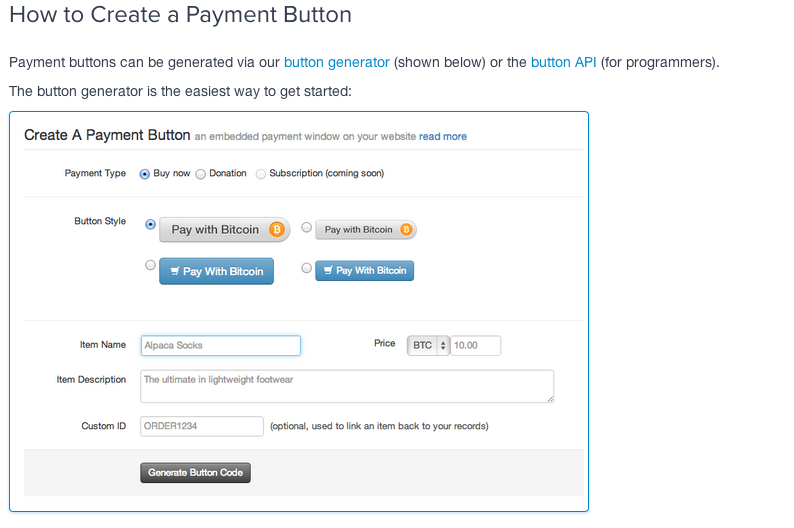

The first option is to add a simple button that users click to pay with Bitcoin. This is very similar to how you can add Paypal buttons to your website. Once you create the button, you are given HTML code that you can embed in your website. This is probably the easiest way to get started with Bitcoin.

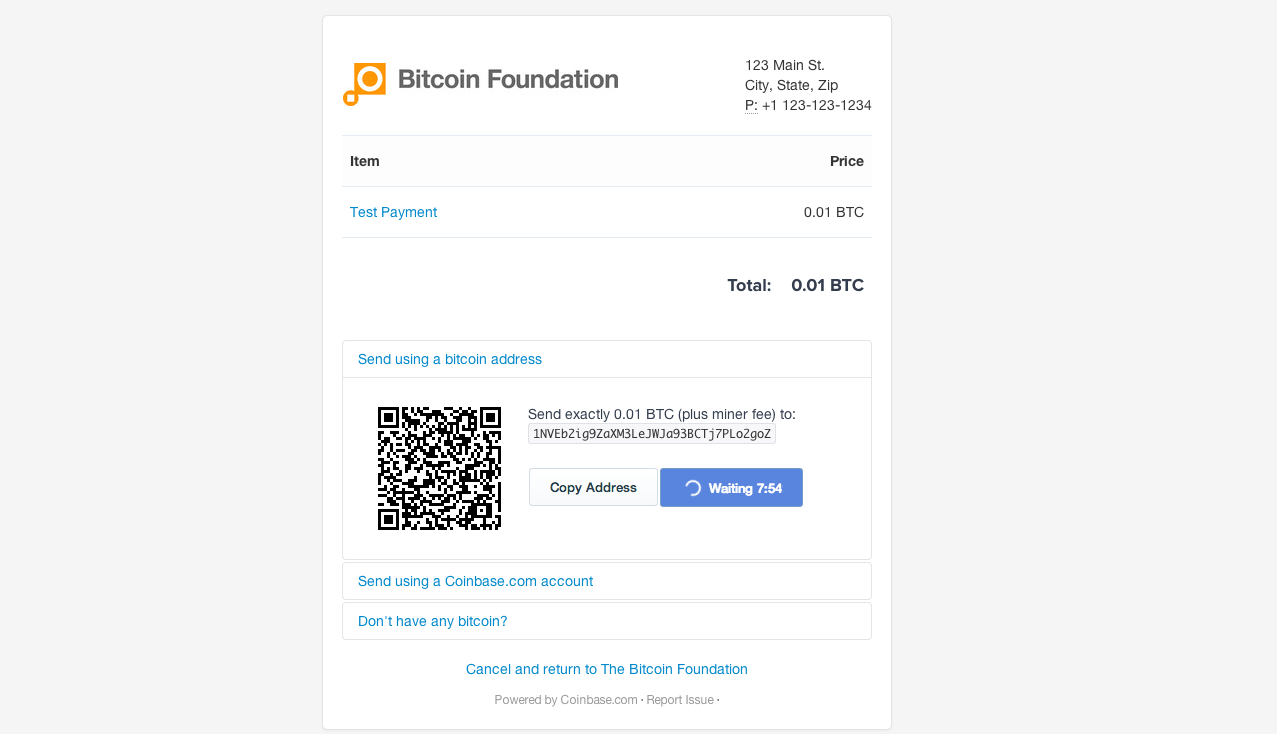

The second option is to use external pages or an iframe. You can create a page (usually hosted by Coinbase or Bitpay) where users will redirect to complete their transaction. This is also very similar to how users will go to a Paypal page to complete their purchase. You could also embed this page as an iframe within your website.

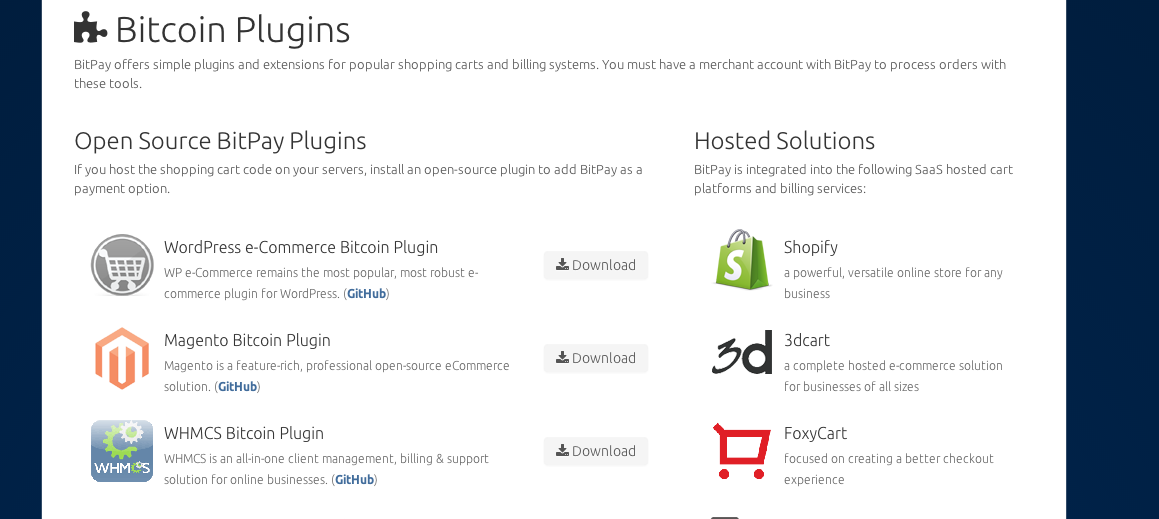

The third option is to use a supported plugin or platform. Both companies have a rapidly growing list of plugins and platforms that make it really easy to connect your Coinbase or Bitpay account.

Bitpay’s list of supported plugins

Coinbase’s list of supported plugins

Both companies also have an API which you can use to create custom integrations. There are also some third party payment companies which are starting to add Bitcoin support like Stripe.

Hopefully this guide has made it clear that accepting Bitcoin shouldn’t be a complicated process! Do you have any questions or concerns around integrating Bitcoin into your online store? Let me know in the comments!

Tagged bitcoin

Featured Image by Francis Storr. Licensed under CC BY-SA 2.0.